By Snehal Desai

ESOP Accounting Guide: Implementing Best Practices | Transcend Capital

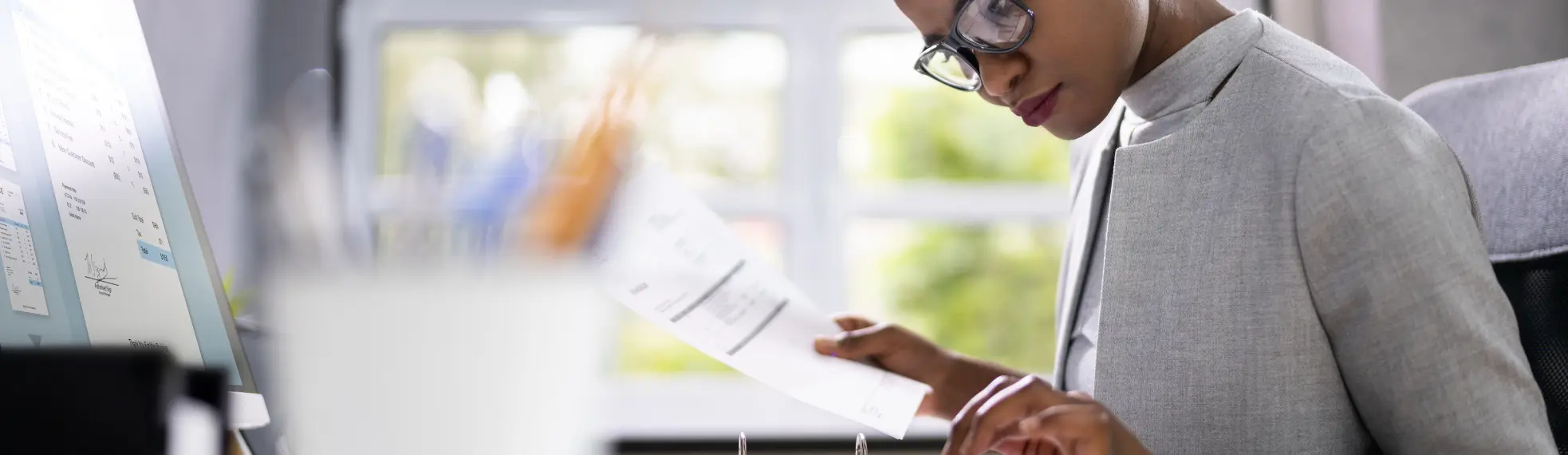

Published in SAICA magazine: Employee Share Ownership Plans (ESOP’s) have become increasing common for multinational, listed and unlisted companies operating in South Africa as a way to attract, retain and reward their employees. ESOP’s can also be effective mechanisms to drive companies’ Broad-based Black Economic Empowerment (BEE) strategies and to align stakeholder and employee values. Accounting for these complex arrangements is a critical success factor that must be carefully considered when evaluating the feasibility of an ESOP.

SHARE-BASED PAYMENTS

Where employees are granted rights to participate in the value of an entity’s equity, IFRS 2 Share-based Payments requires companies to:

- Recognize the fair value of the award as an expense. This fair value is typically based on the market value of the equity instruments at the grant date and is based on the market price of the company’s shares at the grant date and considers factors such as the exercise price, expected volatility, expected dividends and the expected life of the options. IFRS 2 encourages the use of option pricing models as a generally accepted approach for estimating the fair value of equity instruments granted in share-based payment transactions.

- Determine the period over which the employees are expected to provide services in exchange for the awards. The share-based payment expense is recognised over this vesting period.

- Account for the effects of forfeiture, when employees do not meet the vesting conditions and the grants are cancelled or forfeited. Companies must estimate the likelihood of forfeiture and adjust the expense accordingly. Forfeiture rates are typically based on historical experience and can be adjusted for current or expected economic conditions.

- Disclose information about the fair value of the options granted, the vesting period, the method used to estimate the fair value, and the impact of forfeiture. Companies must also disclose the total expense recognized in the financial statements and the impact on earnings per share.

Equity settled versus cash settled share-based payments

Equity settled share-based payments involve the issuance of equity instruments, such as share options to employees. In this arrangement, the company grants the employee the right to acquire a certain number of shares or options, which typically have a vesting period before they can be exercised. Once the vesting period is over, the employee can exercise the options to acquire shares or receive the shares outright.

The expense is recognized over the vesting period of the shares or options granted and is measured at the fair value of the shares or options granted at the date of grant. It is not adjusted for any changes in the fair value of the shares or options over the vesting period. When the options are exercised or the shares are issued, the fair value of the shares or options is transferred within equity from the Share-based Payment reserve to Share Capital.

Cash settled share-based payments, on the other hand, involve the payment of cash to employees as compensation instead of the issuance of equity instruments. In this arrangement, the company grants the employee the right to receive a certain amount of cash, which is linked to the company’s share price. Once the vesting period is over, the employee can receive the cash payment.

The expense is recognized over the vesting period and the expense and corresponding liability is measured at the fair value of the award at the date of grant and is adjusted for any changes in the fair value over the vesting period. When the payment is made, the cash payment is recorded, the Share-based Payment liability is settled and the corresponding expense is recognised in the profit and loss over the vesting period.

Grant Date

Grant Date is a crucial concept as it is the date at which an entity and an employee enter into a shared-based payment arrangement, and it marks the point at which the entity recognizes the cost of the employee services received in exchange for equity instruments. IFRS 2 defines the Grant Date as the date at which the entity and the employee or service provider have a shared understanding of the key terms and conditions of the share-based payment arrangement.

Vesting conditions

Vesting conditions are conditions that employees must satisfy before they are entitled to receive the shares or cash payment associated with the share-based payment.

- Service conditions are typically time-based and relate to the length of time that an employee must remain with the company before they are entitled to receive the shares or cash payment.

- Performance conditions are typically linked to specific performance targets, such as revenue growth, profitability, or share price performance.

CIRCUMSTANCES WHERE IFRS 2 MAY NOT APPLY

IAS 19 – Employee benefits outlines the requirements for the recognition, measurement, and disclosure of employee benefits and requires entities to recognize the cost of providing employee benefits in the period in which they are earned by the employees. The standard defines employee benefits as all forms of consideration given by an entity in exchange for services rendered by employees or for their termination benefits, other than those to which IFRS 2 applies.

Therefore, where share-based payment arrangements do not meet the criteria for the application of IFRS 2, for example a Grant Date cannot be established, the arrangements would fall within the scope of IAS 19.

CONTROL, CONSOLIDATION AND AGENCY

Control and consolidation considerations

In addition to IFRS 2, there are also IFRS 10 – Consolidated Financial Statements considerations that companies must keep in mind when accounting for ESOPs. Often, shares in an entity are held in Trust or Special Purpose Vehicles, for the benefit of the employees eligible to participate in the scheme.

Under IFRS 10, a company must consolidate an entity that it controls. Control is defined as the power to govern the financial and operating policies of an entity to obtain benefits from its activities. In the context of ESOPs, the company must consider whether the ESOP is a separate entity that it controls and therefore should be consolidated in the company’s financial statements. This includes considering factors such as the composition of the ESOP’s board of trustees or directors as the case may be, the company’s ability to appoint or remove such fiduciaries, and the ability to direct the ESOP’s activities (such as determining eligibility criteria for participation).

If the company determines that the ESOP is a separate entity that it controls, then the ESOP’s financial statements must be consolidated in the company’s financial statements.

Agency accounting

Companies must consider whether, in an ESOP arrangement, a Trust or SPV holds its shares on behalf of the employees, creating an agency relationship between the company, the Trust or SPV and the employees. This may have implications for the accounting treatment of the options granted through the ESOP, as the agency accounting principle would require an entity to incorporate the financial statements of an entity which acts as it agent in an arrangement.

Conclusion

Accounting for ESOPs is complex arena and can have a significant impact on the relevance, useability, and comparability of an entity’s financial statements. Companies, working with their advisors and auditors must carefully consider the impact of such arrangements on their financial statements over the life of the scheme.